*Disclaimer: The title is somewhat misleading. While the mathematical derivation of said formulae is straightforward, the fact that Modified Duration is abbreviated by DM instead of MD makes no fucking sense.

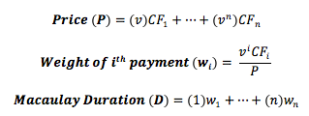

The Macaulay Duration is just the weighted average time at which an investment pays, where the weights are based on the terms in the present value of the sum of cash flows that determine the price of the asset. (Note: v = 1/(1+i) in the equations below for simplicity)

So the Macaulay duration basically considers how large the present value of a given payment is in comparison to the sum of the present values of all payments, which is the price. This weights (i.e. assigns a proportion to) each payment time, so the result is the weighted average time at which the investment pays.

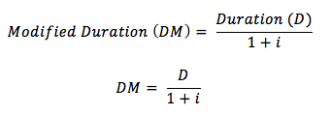

The Modified Duration considers the change in the price of an asset that results from a change in interest rates, which is, mathematically, the derivative of price with respect to interest. The value of an asset is a function of (among other things) interest rates, so we can write P(i) meaning the price of an asset at interest rate i to emphasize that interest is the independent variable and the asset price is the dependent variable. P’(i) is then the rate of change of the price of the asset with respect to interest rates; in other words, the change in value that results from a change in interest rates. You can think of this as “sensitivity” to interest rates. The function P’(i) will always be negative, because the price of an investment is a decreasing function of interest rates. (If you need to convince yourself of this, consider what happens to the value of a series with (1+i) in the denominator as i increases, and vice versa). Whoever came up with the definition of Modified Duration (DM) chose to multiply the expression by -1 so as to “normalize”, if you will, the effect of the negative derivative. Since we know it will be negative by the laws of finance, including the sign is useless and only begs the person using it to make a computational error. Formally, modified duration is the rate of change of the price of an asset/investment with respect to interest rates, expresses as a percentage of the asset’s price.

Now let’s consider how the total change of a function, f(x), that results from a change in the independent variable x can be approximated from a purely mathematical standpoint. The change in the independent variable is not of any interest because it can be freely manipulated and we immediately know what its value is. The dependent variable, however, is more interesting. We don’t automatically know what happens to f(x) when we change x by some small amount dx (d = delta in this case; I couldn’t find it in MS word). The values of f at f(x) and f(x + dx) could be exactly the same or wildly different. The Taylor Series is a way to approximate the value of f(x + dx).

The second expression is the first expression rewritten so as to represent the total change in f instead of the value of f(x + dx). It is derived by noting that the total change of f is equal to f(x + dx) – f(x) and making the appropriate substitution. It’s not necessary to calculate derivatives up to large values of n in most cases, and in many cases a function will only have derivatives of up to a few orders (the exponential function and trig functions are obvious counterexamples). So a lot of times this expression is simplified into taylor polynomials of a given degree, where the degree is the largest derivative considered.

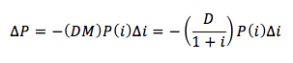

This method of approximation can (and has) been applied to the value of financial assets. The definitions of Macaulay Duration, Modified Duration, and Convexity are direct results of the Taylor Series. The expression below is a first degree approximation of the change in price P(i) that results from a change in interest rates equal to (delta)i, shown below.

How is this related to the modified duration DM? We can rewrite the expression by multiplying it by P(i) / P(i) since it’s equal to 1:

So the first degree taylor series approximation of the change in value of the asset is the negative modified duration multiplied by the price before interest rates changed multiplied by the change in interest rates. We can do the same thing with the second degree taylor polynomial to get an expression in terms of modified duration and convexity:

This is not a coincidence! This is why these formulas make sense. While the mathematical validity of these formulas is important, it does not tell us why they effectively measure interest rate risk explicitly. To show this, first note the following relationship between the duration and modified duration:

We’ve already derived an expression for the 1st degree approximation of the change in asset value; rewrite this expression both in terms of Duration and Modified Duration:

The clear implication of the expression above is that longer duration investments undergo greater price changes than shorter duration investments when interest rates change, which suggests assets with longer durations are more volatile. This shouldn’t be surprising – think about what happens to a bond holder when interest rates change. His coupon payment is fixed (generally speaking) but his cash flows are discounted by a higher number – so the ratio in each term, payments to discount factor, decreases. Since the discount factor increases exponentially with time, payments further in the future are disproportionally affected by the change in rates. Therefore, bond holders with longer terms will be worse off than short term bondholders.